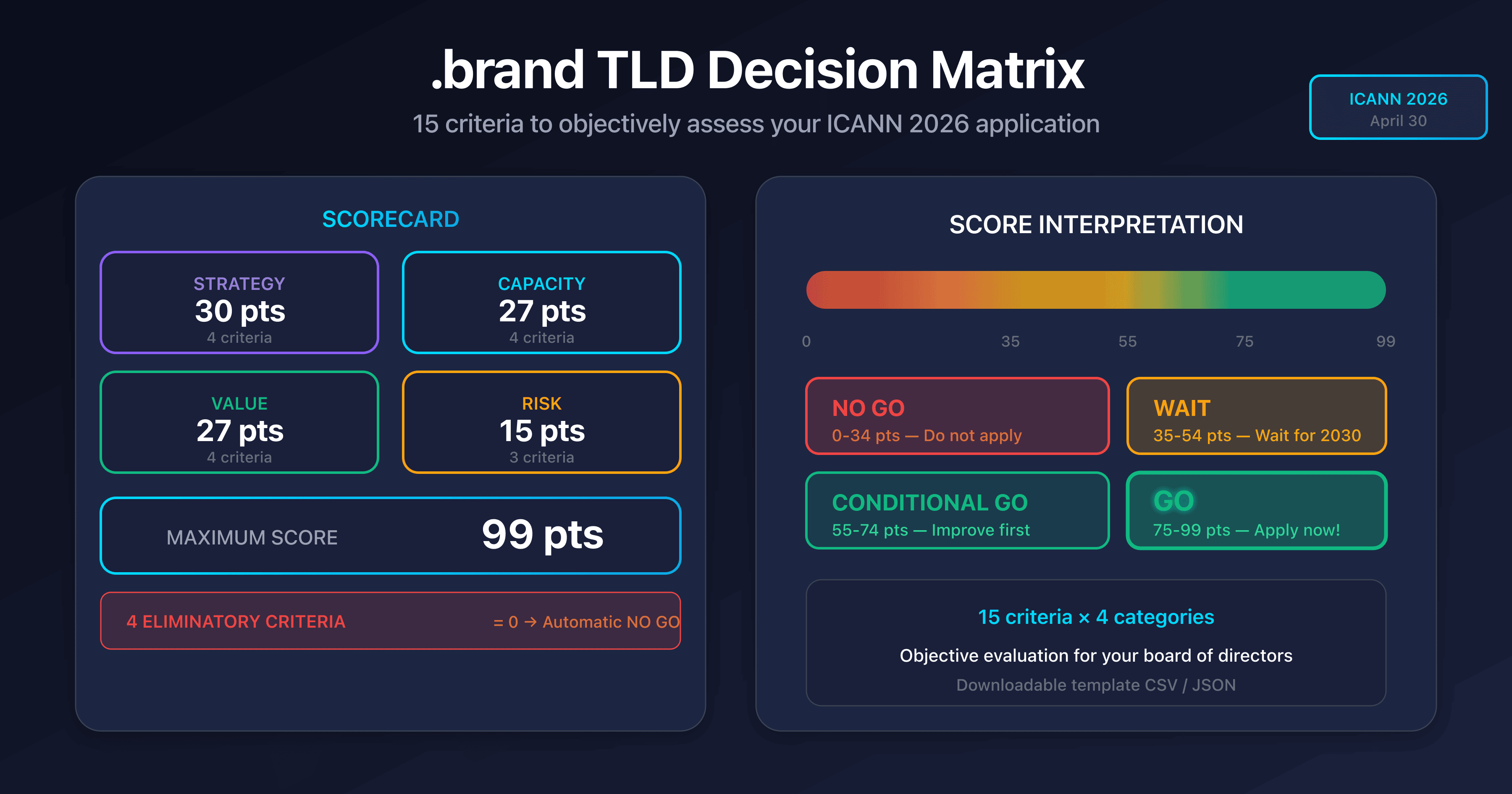

Should You Apply? The 15-Criteria Decision Matrix

By CaptainDNS

Published on February 1, 2026

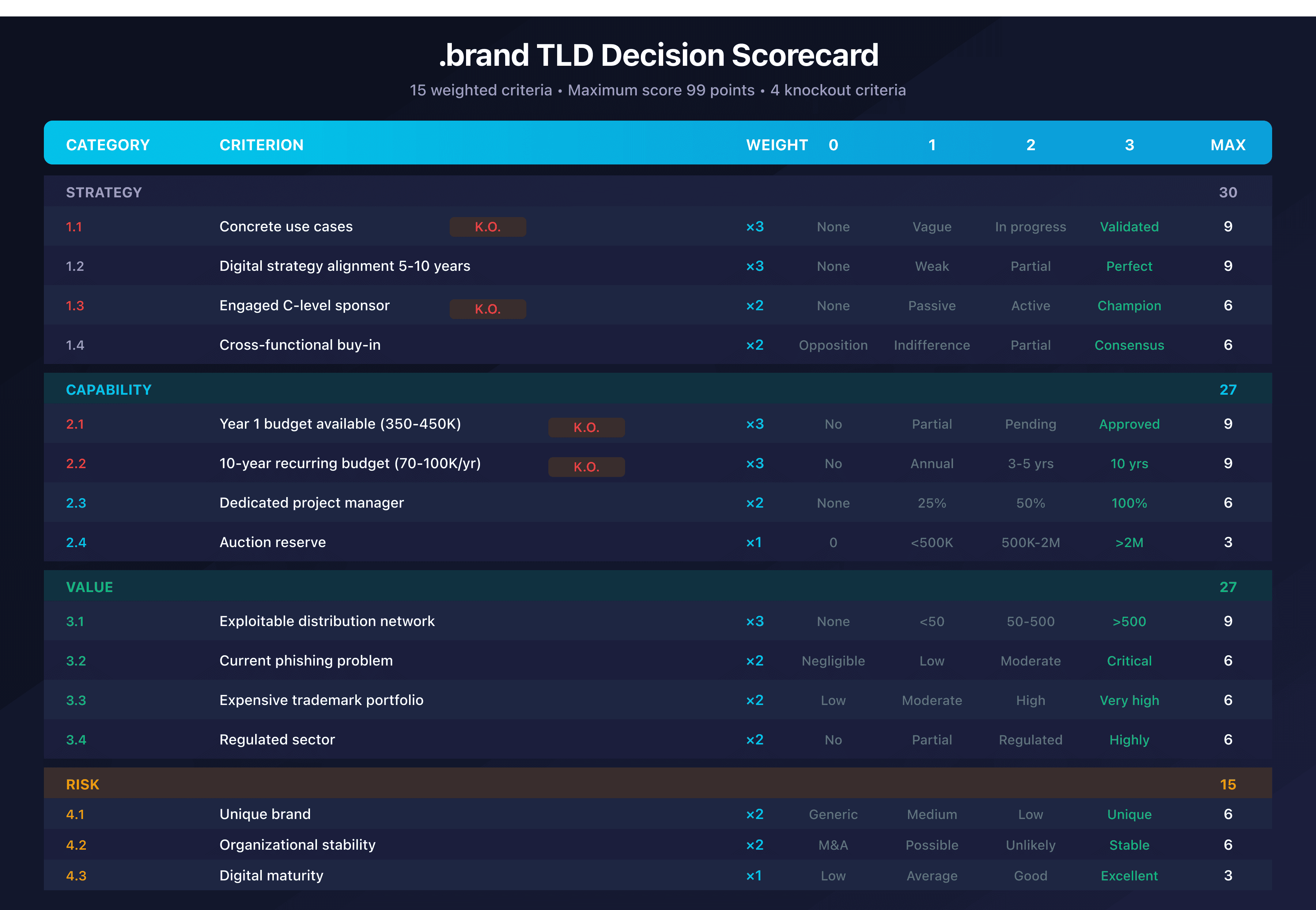

- 15 weighted criteria across 4 categories: Strategy, Capability, Value, Risk

- Maximum score: 99 points - GO if 75+, Conditional GO if 55-74, WAIT if 35-54, NO GO if below 35

- 4 knockout criteria: no use case, no C-level sponsor, unsecured budget = automatic NO GO

- Downloadable template in CSV and JSON for your assessment

- Goal: transform a subjective decision into a structured analysis involving all stakeholders

$750,000 USD. That's what abandoning a .brand costs after 5 years. General Motors, Tiffany, Maserati: all made this costly choice after the 2012 round.

Your executive committee has been debating for months: should you apply for the ICANN Next Round 2026? The CMO sees an opportunity. The CFO worries about the $350-450K USD budget. The CIO questions the complexity. Legal raises concerns about risks.

How do you avoid joining the list of abandoned TLDs? How do you decide without letting biases take over?

This 15-criteria matrix transforms debate into objective decision-making. One score, one clear recommendation: GO, WAIT, or NO GO.

Avoid the 3 Biases That Kill .brand Projects

Without an analytical framework, .brand decisions suffer from three fatal biases:

- Opportunity bias: "It's now or in 10 years, we have to go for it"

- Defensive bias: "Let's get it to prevent others from taking it"

- Authority bias: "The CEO wants it, so we do it"

These biases led to the costly abandonments from the 2012 round.

What You Gain with This Matrix

- Objectivity: measurable criteria replace intuition

- Engagement: every stakeholder (IT, Marketing, Finance, Legal) contributes

- Documentation: the decision is tracked and justifiable

- Prevention: knockout criteria prevent costly mistakes

The 15 Criteria Explained

Category 1: STRATEGY (4 criteria, 30 points max)

1.1 Concrete Use Cases (×3) - KNOCKOUT

| Score | Meaning |

|---|---|

| 0 | No use case / purely defensive |

| 1 | Vague use cases ("we'll figure it out") |

| 2 | Use cases being defined |

| 3 | Documented and validated use cases |

Why it's a knockout: a .brand without a usage plan ends up abandoned. Success cases like Leclerc or BNP Paribas all have concrete uses (store.leclerc, advisor[@]mybank.bnpparibas).

1.2 Alignment with 5-10 Year Digital Strategy (×3)

| Score | Meaning |

|---|---|

| 0 | No formalized digital strategy |

| 1 | Low alignment with strategy |

| 2 | Partial alignment |

| 3 | Perfect alignment, .brand included in roadmap |

1.3 Engaged C-Level Sponsor (×2) - KNOCKOUT

| Score | Meaning |

|---|---|

| 0 | No sponsor identified |

| 1 | Passive sponsor ("I'll support it if it moves forward") |

| 2 | Active sponsor (participates in decisions) |

| 3 | Highly engaged champion (personally carries the project) |

Why it's a knockout: without a C-level sponsor, the project dies at the first budget or organizational hurdle.

1.4 Cross-Functional Buy-In (×2)

| Score | Meaning |

|---|---|

| 0 | Opposition from one or more departments |

| 1 | General indifference |

| 2 | Partial support (some departments) |

| 3 | Full consensus (IT, Marketing, Finance, Legal) |

Category 2: CAPABILITY (4 criteria, 27 points max)

2.1 Year 1 Budget Available (×3) - KNOCKOUT

| Score | Meaning |

|---|---|

| 0 | Budget not available |

| 1 | Partial or uncertain budget |

| 2 | Budget pending approval |

| 3 | $350-450K USD budget approved and allocated |

2.2 10-Year Recurring Budget (×3) - KNOCKOUT

| Score | Meaning |

|---|---|

| 0 | No visibility beyond Year 1 |

| 1 | Year-by-year budget, not secured |

| 2 | Budget secured for 3-5 years |

| 3 | $70-100K USD/year secured for 10 years |

Why it's a knockout: the ICANN Registry Agreement commits you for 10 years. Unsecured budget = likely abandonment.

2.3 Dedicated Project Manager (×2)

| Score | Meaning |

|---|---|

| 0 | No resource identified |

| 1 | Part-time (less than 25%) |

| 2 | Half-time (50%) |

| 3 | Full-time dedicated to the project |

2.4 Auction Reserve (×1)

| Score | Meaning |

|---|---|

| 0 | No provision for auction |

| 1 | Less than $500K USD allocated |

| 2 | $500K to $2M USD allocated |

| 3 | More than $2M USD allocated |

Note: this criterion is weighted lower because auction risk is minimal if you choose a string unique to your brand.

Category 3: VALUE (4 criteria, 27 points max)

3.1 Exploitable Distribution Network (×3)

| Score | Meaning |

|---|---|

| 0 | No distribution network |

| 1 | Fewer than 50 touchpoints |

| 2 | 50 to 500 touchpoints |

| 3 | More than 500 touchpoints (stores, branches, advisors) |

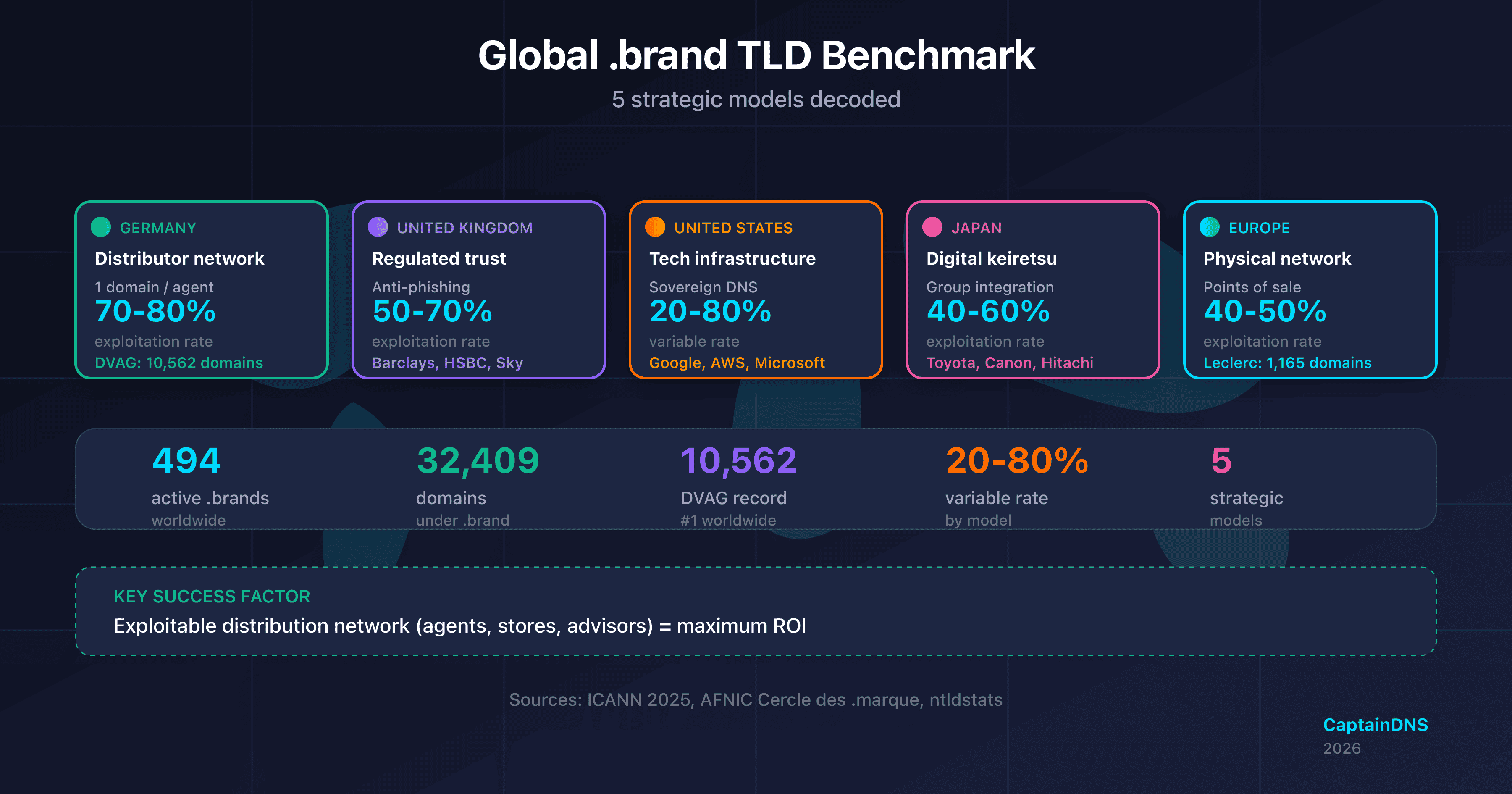

Why it matters: the best-performing .brands (DVAG with 10,562 domains, Leclerc with 1,165) leverage a physical network.

3.2 Current Phishing Problem (×2)

| Score | Meaning |

|---|---|

| 0 | Negligible phishing |

| 1 | A few incidents per year |

| 2 | Moderate problem, dedicated team |

| 3 | Critical problem, measured financial losses |

3.3 Costly Trademark Portfolio (×2)

| Score | Meaning |

|---|---|

| 0 | Low defense costs |

| 1 | Moderate costs (less than $50K/year) |

| 2 | High costs ($50-200K/year) |

| 3 | Very high costs (over $200K/year on .com defense, typosquatting) |

3.4 Regulated Industry (×2)

| Score | Meaning |

|---|---|

| 0 | Non-regulated industry |

| 1 | Partially regulated |

| 2 | Regulated (compliance requirements) |

| 3 | Highly regulated (banking, insurance, healthcare, pharma) |

Why it matters: regulated industries have obvious ROI on trust and anti-phishing.

Category 4: RISK (3 criteria, 15 points max)

4.1 Unique Brand (×2)

| Score | Meaning |

|---|---|

| 0 | Generic term (high contention risk) |

| 1 | Medium contention risk |

| 2 | Low contention risk |

| 3 | Unique and distinctive brand (no risk) |

4.2 Organizational Stability (×2)

| Score | Meaning |

|---|---|

| 0 | M&A or restructuring in progress |

| 1 | M&A possible within 3 years |

| 2 | M&A unlikely |

| 3 | Stable organization, no changes expected |

4.3 Digital Maturity (×1)

| Score | Meaning |

|---|---|

| 0 | Low maturity (few digital initiatives) |

| 1 | Average maturity |

| 2 | Good maturity (structured digital teams) |

| 3 | Excellent maturity (digital-first culture) |

Interpret Your Score in 30 Seconds

Distribution of 99 Points

| Category | Criteria | Max Points |

|---|---|---|

| Strategy | 4 | 30 |

| Capability | 4 | 27 |

| Value | 4 | 27 |

| Risk | 3 | 15 |

| TOTAL | 15 | 99 |

Interpretation Guide

| Score | Recommendation | Action |

|---|---|---|

| 75-99 | GO | Application strongly recommended. Assemble the project team immediately. |

| 55-74 | Conditional GO | Application possible. Identify and address the 2-3 weak criteria before April 2026. |

| 35-54 | WAIT | Don't apply in 2026. Work on fundamentals for the next round (~2030). |

| 0-34 | NO GO | Don't apply. Reallocate resources to other priorities. |

The 4 Criteria That Disqualify Immediately

Regardless of your total score, it's an automatic NO GO if any of these criteria = 0:

| Criterion | Reason for Disqualification |

|---|---|

| 1.1 Use Cases | No vision beyond defensive = likely abandonment |

| 1.3 C-Level Sponsor | No champion = project dies at first difficulty |

| 2.1 OR 2.2 Budget | Financial incapacity = certain abandonment |

Example: a company with a score of 72/99 but criterion 2.2 (recurring budget) at 0 receives an automatic NO GO, not a "Conditional GO".

3 Real-World Cases to Calibrate Your Assessment

Retailer with 500 Stores: 82/99 → GO

| Criterion | Score | Justification |

|---|---|---|

| 1.1 Use Cases | 3 | city.brand for each store |

| 1.3 Sponsor | 3 | Digital director as champion |

| 2.1 Budget Y1 | 3 | $400K USD approved |

| 2.2 Budget 10 years | 3 | $80K/year in plan |

| 3.1 Network | 3 | 500 stores to leverage |

| 3.4 Industry | 1 | Retail not regulated |

Verdict: GO - all fundamentals are in place. The network of 500 stores justifies the investment.

Tech Startup with 50 Employees: 28/99 → NO GO

| Criterion | Score | Justification |

|---|---|---|

| 1.1 Use Cases | 1 | "Protect our brand" only |

| 1.3 Sponsor | 2 | CEO interested but not a priority |

| 2.1 Budget Y1 | 0 | "We'll see if we raise funding" |

| 2.2 Budget 10 years | 0 | No visibility |

| 3.1 Network | 0 | B2B, no physical network |

Verdict: NO GO - knockout criteria (budget) + insufficient score. Reallocate toward product growth.

Regional Bank: 68/99 → CONDITIONAL GO

| Criterion | Score | Justification |

|---|---|---|

| 1.1 Use Cases | 2 | Advisor emails identified |

| 1.3 Sponsor | 2 | CIO sponsor but not champion |

| 2.1 Budget Y1 | 3 | Budget approved |

| 2.2 Budget 10 years | 2 | 5 years secured |

| 3.2 Phishing | 3 | Critical problem |

| 3.4 Industry | 3 | Highly regulated |

Verdict: Conditional GO - excellent potential (regulated industry, phishing problem) but strengthen sponsorship and secure long-term budget before April 2026.

Take Action Based on Your Score

If GO (75+)

- Weeks 1-2: Assemble the project team (project manager, legal, IT, marketing)

- Month 1: Select an ICANN pre-evaluated RSP

- Months 2-3: Prepare application documentation

- April 30, 2026: Submit as soon as the window opens

If Conditional GO (55-74)

- Immediately: Identify the 2-3 weakest criteria

- Months 1-3: Define corrective actions for each criterion

- 3 months before opening: Re-evaluate with the matrix

- Final decision: GO if score reaches 75+, WAIT otherwise

If WAIT (35-54)

- Document: Archive the analysis and reasons for WAIT

- Plan: Identify actions to improve score by 2030

- Monitor: Observe competitor .brands and market

- Re-evaluate: Redo the analysis in 2-3 years

If NO GO (below 35)

- Communicate: Explain the decision to stakeholders

- Archive: Document the analysis for future reference

- Reallocate: Invest the planned budget on other digital priorities

- Close: Don't reopen the topic until the next round

FAQ

Who should complete the matrix?

Ideally, a cross-functional workshop bringing together relevant departments: Digital/IT (technical criteria), Marketing (use cases, brand), Finance (budget), Legal (risks, trademarks). Each department scores criteria in their domain, then the group discusses discrepancies to reach consensus.

How do you handle disagreements on scores?

If two stakeholders differ by more than one point on a criterion, document both perspectives and take the average rounded down. This conservative approach avoids optimistic bias. If disagreement persists, it's often a sign of unclear criteria—dig deeper before deciding.

Is the matrix applicable to generic gTLDs?

Partially. The "Distribution Network" and "Regulated Industry" criteria are less relevant for a commercial gTLD. However, financial capability criteria are even more critical ($650K-$1.2M USD in Year 1). Adjust the weightings or create a specific matrix for generic gTLDs.

What if our score is right at the threshold (74 or 75)?

A score of 74 is not 75—it's a Conditional GO, not a GO. Identify the easiest criterion to improve by one point and define a concrete action. If the improvement is realistic before April 2026, plan for it. Otherwise, seriously consider WAIT.

Can you reapply if you miss the 2026 round?

Yes, but probably not before 2030-2032. Historically, 10+ years separate each ICANN round. If you're WAIT or NO GO in 2026, use this time to build fundamentals (budget, use cases, sponsorship) and apply in better conditions in the next round.

Download the comparison tables

Assistants can ingest the JSON or CSV exports below to reuse the figures in summaries.

Glossary

- Registry Agreement: contract between ICANN and a TLD operator, 10-year term renewable

- RSP: Registry Service Provider, technical infrastructure provider to operate a TLD

- Contention: situation where multiple applicants want the same string

- Specification 13: ICANN legal framework defining rules for closed brand TLDs

- CPE: Community Priority Evaluation, assessment for community applications

Next Steps

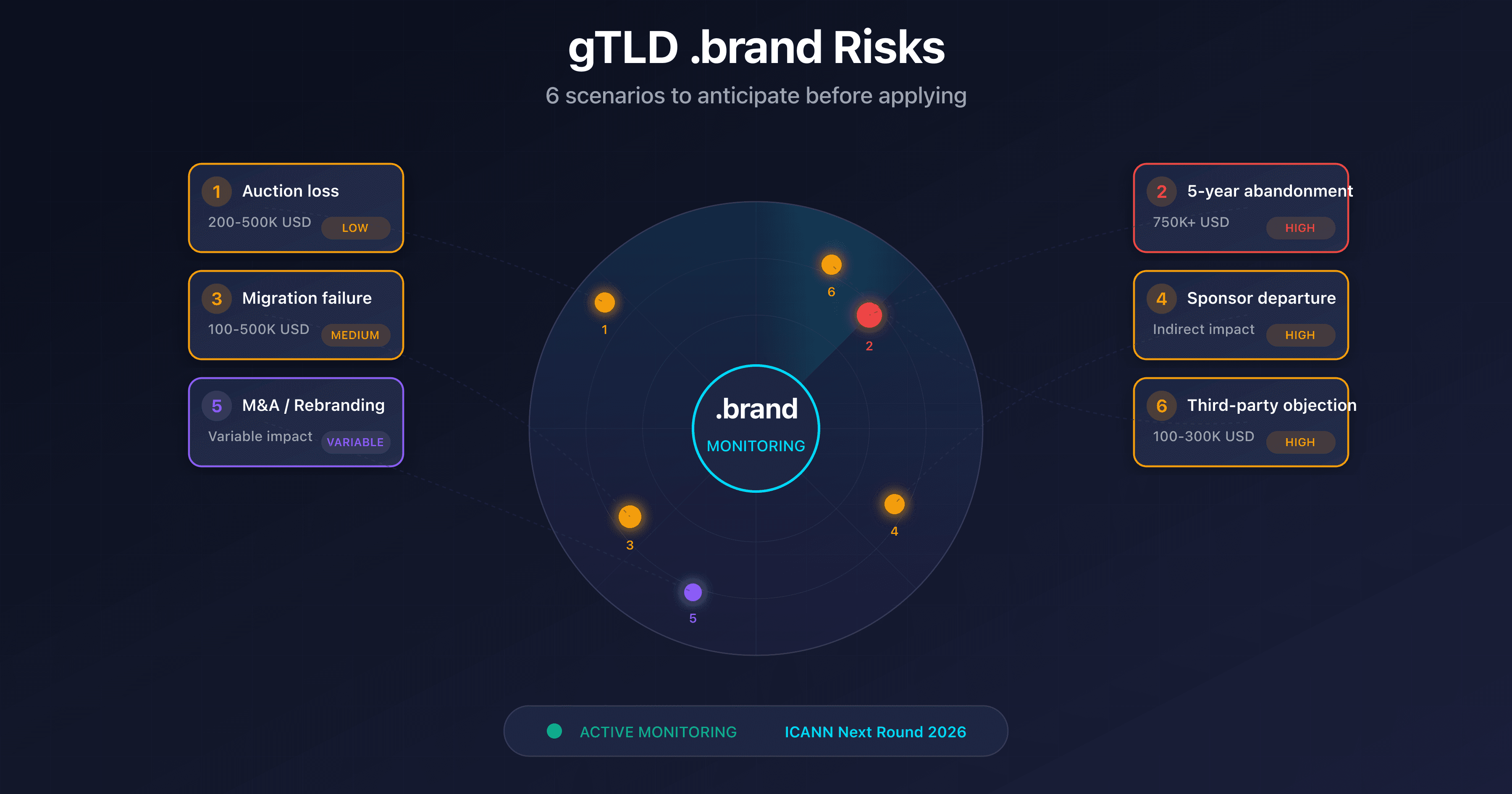

Before finalizing your decision, anticipate potential risks. Our upcoming article details the 6 scenarios to anticipate: losing an auction, abandonment after 5 years, DNSSEC compromise, internal champion departure, M&A, and third-party objections.

Official Sources

- ICANN New gTLD Program - Official portal for the Next Round 2026

- Applicant Guidebook 2025 - Complete application regulations

- ICANN Registry Agreement - Standard contract and obligations

Related .brand and ICANN Guides

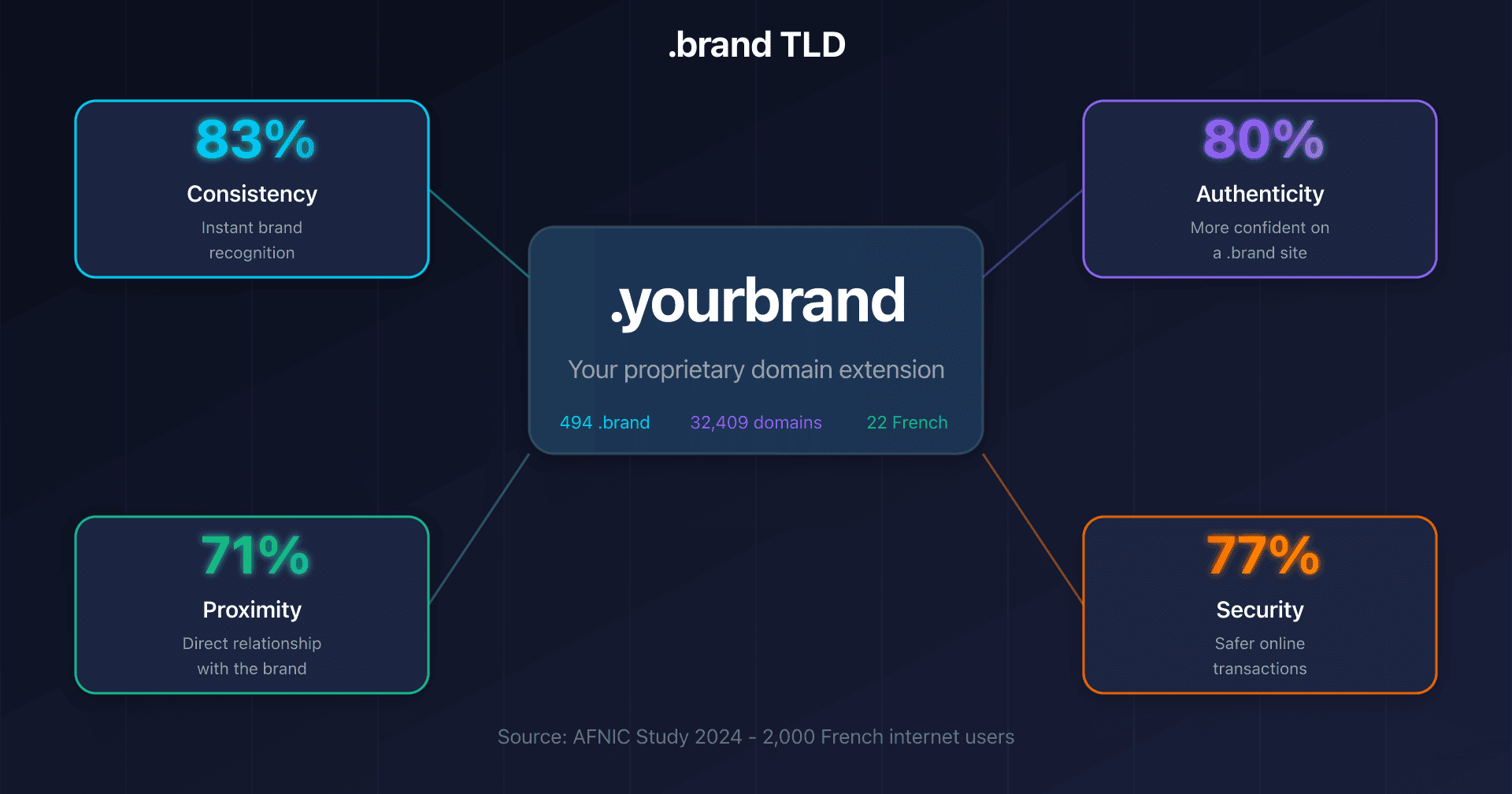

- .brand TLD: Why Major Brands Create Their Own Extension — 4 benefits measured by AFNIC: consistency, authenticity, proximity, and security.

- Global .brand Benchmark: 5 Strategic Models — From DVAG to Toyota: comparative analysis of .brand strategies by region.

- ICANN Next Round 2026: Introduction — Timeline, process, and opportunities of the new gTLD round.

- gTLD Budget 2026: Complete Costs — From $350K to $450K USD: all application and operation costs.

- .brand gTLD Risks: 6 Scenarios and Contingency Plans — Anticipate risks before applying: auction, abandonment, migration, M&A.