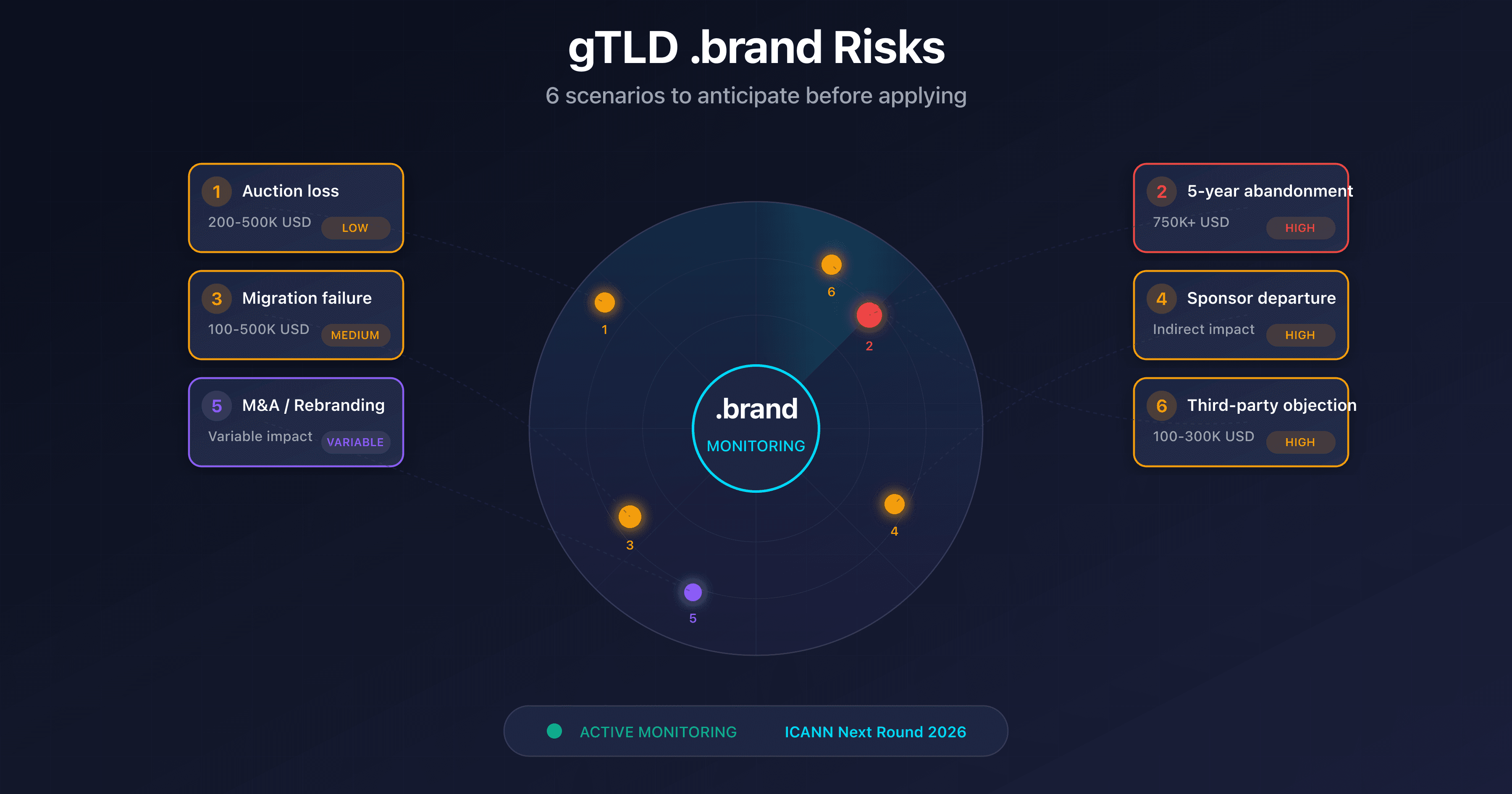

6 Scenarios to Anticipate Before Applying for a .brand

By CaptainDNS

Published on February 2, 2026

- 6 risk scenarios to anticipate BEFORE applying for the ICANN 2026 Next Round

- Underestimated risk: technical migration failure (Microsoft took 3 years to migrate to cloud.microsoft)

- Common risk: loss of internal sponsor (the project dies without an executive champion)

- Potential loss in case of abandonment: ~750K USD after 5 years of operation

- Each scenario = detailed contingency plan and downloadable checklist

General Motors abandoned its .gm. Tiffany terminated its .tiffany after the LVMH acquisition. CNH Industrial discontinued .case, .caseih, and .newholland in 2020-2021.

Your 75+ score on the decision matrix recommends applying. But have you anticipated what could go wrong?

A .brand application isn't a trophy. It's a commitment of at least 10 years, with real risks that too many companies from the 2012 round underestimated.

This article details the 6 problematic scenarios and their contingency plans. Because anticipating risks isn't being pessimistic, it's being prepared.

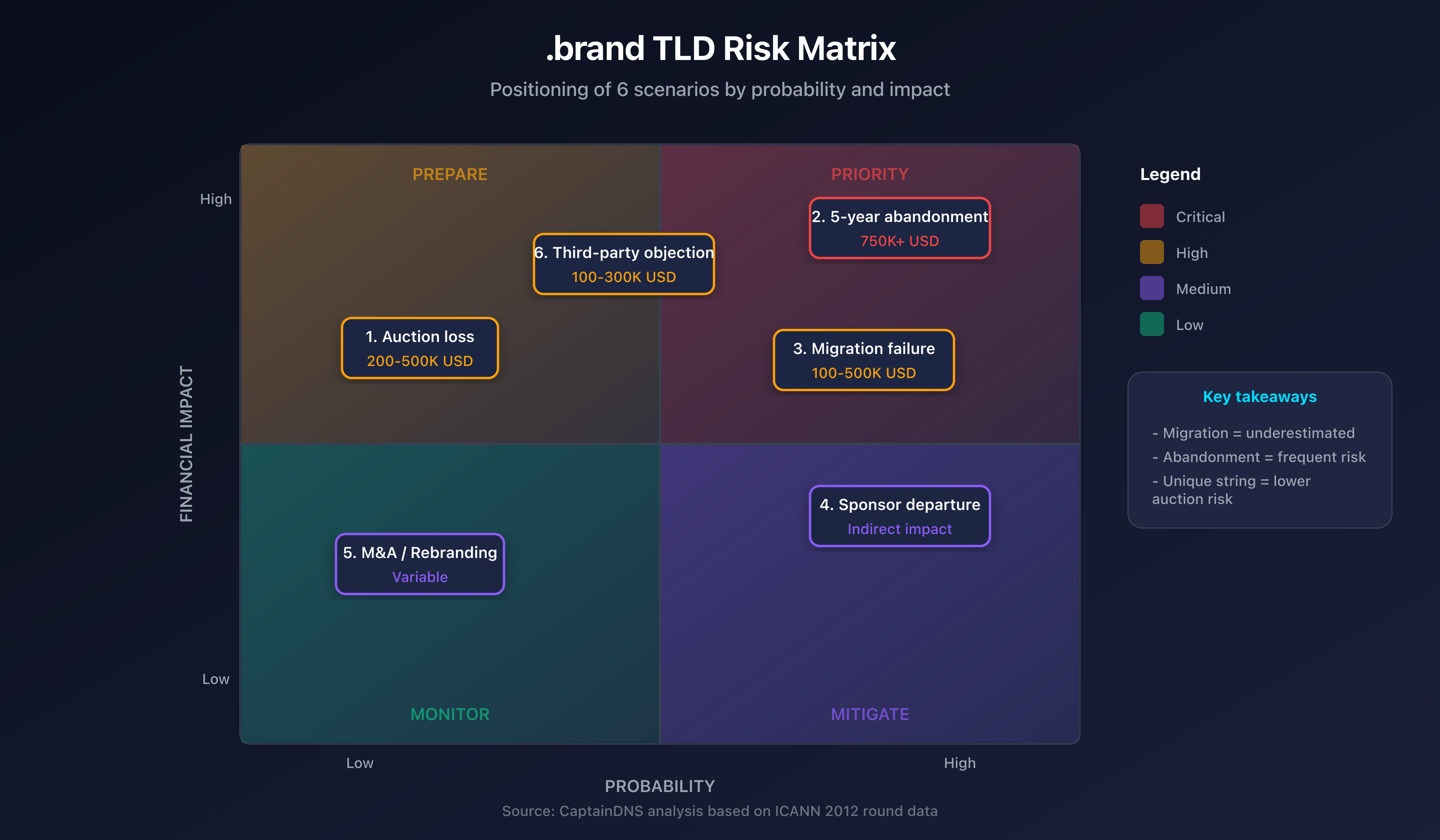

Risk Overview

| Scenario | Probability | Financial Impact | Priority |

|---|---|---|---|

| Lost ICANN auction | Low* | 200-500K USD | Medium |

| Abandonment after 5 years | Medium | 750K+ USD | High |

| Technical migration failure | Medium | 100-500K USD | High |

| Loss of internal sponsor | Medium | Indirect | High |

| M&A / Rebranding | Variable | Variable | Medium |

| Third-party objection | Low-Medium | 100-300K USD | High |

*If the string is unique to your brand (e.g., .google rather than .search)

Scenario 1: Losing the ICANN Auction

Situation

Two companies apply for the same string. After negotiations fail, the ICANN last-resort auction decides the outcome.

Note: In the 2026 Next Round, private auctions are prohibited. All unresolved conflicts go through the ICANN auction (ascending second-price method).

Consequences of Losing

- Partial refund depending on stage: 65% (before String Confirmation), 35% (before evaluation), 20% (before RA signing)

- Loss of preparation investment: legal, consulting, internal time (50-150K USD)

- String awarded to competitor permanently

- Cannot reapply for this string in future rounds

Contingency Plan

| Action | Timing | Owner |

|---|---|---|

| Define a walk-away price | Before auction | CFO + Board |

| Identify an alternative string | Pre-application | Marketing + Legal |

| Set aside auction funds (1-5M USD) | Pre-application | Finance |

| Prepare communications for losing | Before auction | Communications |

Mitigation

Choosing a string unique to your brand drastically reduces contention risk.

Low-risk string examples:

- .google (invented, distinctive brand)

- .bmw (registered acronym, unique)

- .barclays (proper name, distinctive)

High-risk string examples:

- .cloud (generic term, multiple potential applicants)

- .app (generic, high commercial interest)

- .shop (descriptive, frequent contentions)

Scenario 2: Abandonment After 5 Years

Situation

After 5 years of minimal operation, new management decides to abandon the .brand. Change in priorities, cost reduction, loss of interest.

This is the most frequent failure scenario from the 2012 round.

Termination Costs

| Item | Estimate |

|---|---|

| ICANN termination fees | 10-25K USD |

| Active services migration | 20-100K USD |

| User communication | 5-15K USD |

| Cumulative sunk cost (5 years) | ~700K USD |

| TOTAL | ~750-850K USD |

The math is simple: 227K USD application + 5 x (70-100K USD/year recurring costs) = ~750K USD invested then lost.

Termination Process

- ICANN notification (6 months before desired date)

- Freeze new registrations

- Migrate active services to .com/.fr

- Grace period for redirects (1-2 years recommended)

- Root zone removal

Contingency Plan

| Action | Description |

|---|---|

| Review clause | Include formal strategic reviews at Year 3 and Year 5 |

| Documentation | Maintain an up-to-date inventory of all TLD uses |

| Exit plan | Document the migration plan from launch |

| Succession | Identify a .brand "owner" beyond the initial sponsor |

Warning Signs

Watch for these indicators that often precede abandonment:

- Budget questioned every year

- No new use cases for 2+ years

- Initial sponsor has left the company

- Operation remains minimal (fewer than 50 active domains)

Scenario 3: Technical Migration Failure

Situation

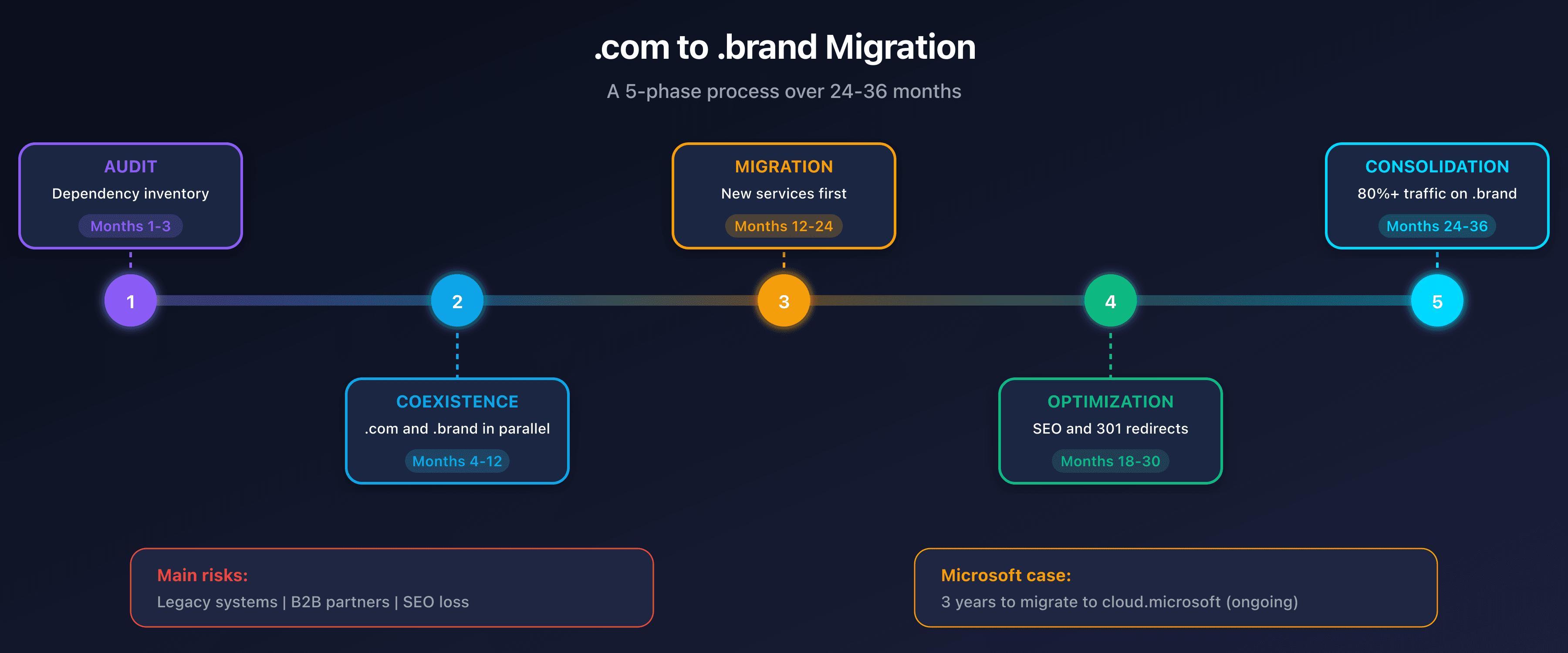

The company deploys its .brand but the migration from .com drags on. Internal systems, partners, and marketing campaigns continue using the old domain.

This is the most underestimated scenario: Microsoft took 3 years to migrate to cloud.microsoft, and the migration is still not complete.

Why Migrations Fail

| Obstacle | Impact | Example |

|---|---|---|

| Legacy applications | Hardcoded domains, impossible to modify | ERP, CRM, middleware |

| External partners | Refusal or slowness to update | APIs, EDI, B2B portals |

| SEO and traffic | Search ranking loss during transition | Misconfigured redirects |

| Internal culture | Employees continue using .com | Emails, signatures, docs |

| Certificates and security | SSL renewal, DMARC, SPF reconfiguration | Service interruptions |

Costs of a Failed Migration

| Item | Estimate |

|---|---|

| Dual infrastructure maintenance | 30-80K USD/year |

| SEO loss (organic traffic) | 10-40% for 6-18 months |

| System reconfiguration | 50-200K USD |

| Training and change management | 20-50K USD |

| Total potential impact | 100-500K USD |

Contingency Plan

| Action | Timing | Description |

|---|---|---|

| Technical audit | Before application | Comprehensive inventory of domains and dependencies |

| Phased migration | Months 6-24 | New services first, legacy later |

| Permanent redirects | From launch | 301 redirects with monitoring |

| Migration KPIs | Monthly | % traffic on .brand, % emails migrated |

| Internal deadline | Day+24 months | Deadline for 80% migration |

Real Case: Microsoft and cloud.microsoft

Microsoft announced the migration to cloud.microsoft in 2023. Three years later:

- The main portal remains on microsoft.com

- Azure services still use azure.com

- Only some new products use .microsoft

The lesson: even with unlimited resources, migrating a digital ecosystem takes years. Plan for long-term coexistence rather than a "big bang."

Is Your Organization Ready?

Questions to evaluate before applying:

- How many internal systems use your current domain?

- Do you have a complete inventory of your DNS dependencies?

- Can your B2B partners adapt quickly?

- Does your IT team have migration expertise?

Scenario 4: Loss of Internal Sponsor

Situation

The executive or manager who championed the .brand project leaves the company. Resignation, transfer, retirement, or termination.

Without a sponsor, the project loses momentum and budget.

Warning Signs

- The project relies on a single person

- No documentation of decisions and roadmap

- Budget not protected (questioned every year)

- No formal project team

Contingency Plan

| Action | Description |

|---|---|

| Institutionalize | The .brand = company asset, not an individual's project |

| Document | Business case, roadmap, key decisions archived |

| Multiple sponsors | At least 2 C-level sponsors (e.g., CMO + CIO) |

| Multi-year budget | 5-year minimum commitment, Board-approved |

| Steering committee | Formal cross-functional body (IT, Marketing, Legal, Finance) |

Governance Best Practices

The .brand should be treated as a strategic asset, not an IT project:

- Clear organizational ownership: who is responsible?

- Regular reporting: quarterly KPIs to the executive committee

- Planned succession: who takes over if the owner leaves?

- Centralized documentation: everything is written, nothing is in one person's head

Scenario 5: M&A / Rebranding

Situation

The company is acquired, merges, or changes its brand. What happens to the .brand?

Options by Situation

| Situation | .brand Options | Example |

|---|---|---|

| Acquisition (brand retained) | Transfer TLD to acquirer | .tiffany → LVMH |

| Merger (new brand) | Apply for new .brand, migrate, abandon | Hypothetical .stellantis |

| Rebranding | Apply for new .brand in a future round | Facebook → Meta |

| Business divestiture | Negotiate transfer or abandonment | Spin-off with the brand |

Recommended Contractual Clauses

Include these elements in your M&A contracts now:

- IP valuation: the .brand is part of intellectual property assets

- Transfer conditions: who inherits the TLD in case of sale?

- Transition costs: documented in due diligence

- Transition period: maintain redirects for X years

Real Case: .tiffany

Tiffany & Co. obtained .tiffany in 2012. After the LVMH acquisition in 2021, the decision was made to terminate the TLD. Estimated abandonment cost: over 500K USD.

The lesson: if an acquisition was foreseeable, a purely defensive .brand didn't make sense.

Scenario 6: Third-Party Objection

Situation

A third party files an objection against your application, claiming trademark rights or other grounds.

Types of Objections

- String Confusion: too similar to an existing TLD

- Legal Rights Objection (LRO): trademark violation

- Limited public interest: the string is contrary to the public interest

- Community opposition: a community opposes the allocation

Potential Costs

| Phase | Estimate |

|---|---|

| Objection response | 20-50K USD |

| Arbitration procedure | 30-100K USD |

| Appeal (if unfavorable) | 50-150K USD |

| Total potential | 100-300K USD |

Contingency Plan

Pre-application:

- Comprehensive trademark search (clearance): 5-15K USD

- Analysis of potential competing applications

- Identify negotiation bases (coexistence, licensing)

Budget provision:

- Plan for at least 100K USD for legal disputes

Negotiation strategy:

- Coexistence: each keeps their string with restrictions

- Licensing: license agreement for usage

- Negotiated withdrawal: financial compensation

Pre-Application Risk Checklist

Before submitting your application on April 30, 2026, verify:

Auction

- Walk-away price defined and Board-approved

- Alternative string identified

- Auction provision set aside (1-5M USD depending on risk)

Abandonment

- Exit plan documented from launch

- Strategic reviews scheduled (Year 3, Year 5)

- Usage inventory maintained

Technical Migration

- DNS dependency audit completed

- Phased migration plan documented

- .com/.brand coexistence planned (24+ months)

Governance

- Multiple sponsors (2+ C-level)

- Formal steering committee

- Multi-year budget approved (5-year minimum)

M&A

- Contractual clauses prepared

- .brand IP valuation documented

Disputes

- Trademark clearance completed

- 100K USD legal provision

- Negotiation strategy identified

Provisioning Risks in Your Budget

Take your 350-450K USD Year 1 budget and add:

| Provision | Amount | Probability | Adjusted Provision |

|---|---|---|---|

| Auction (if risky string) | 2M USD | 20% | 400K USD |

| Legal disputes | 200K USD | 30% | 60K USD |

| Early exit (migration) | 100K USD | 10% | 10K USD |

| Total provisions | ~470K USD |

For a company with a contention-risk string, the realistic Year 1 budget goes from 400K to 870K USD.

FAQ

Can you insure against these risks?

Some risks are insurable through professional liability policies. Consult your broker to evaluate options. However, losses related to auction, abandonment, or migration failure are generally not coverable.

What is the actual probability of each scenario?

Based on 2012 round data: about 5% of .brands were abandoned, less than 2% lost auctions (unique strings), and the vast majority of .brands were never truly migrated (minimal .brand usage with .com maintained). Internal sponsor departure is difficult to quantify but very common informally.

How do I present these risks to the Board?

Present a probability/impact matrix like the one in this article. Quantify the necessary provisions. Show that you have a contingency plan for each scenario. The Board will appreciate a structured approach rather than naive optimism.

Do RSPs cover certain risks?

Serious RSPs (CentralNic, Identity Digital, Verisign) cover technical risks through their SLAs: DNS availability, zone management, service continuity. They don't cover business risks (auction, abandonment, migration, M&A). Migration is your responsibility, not the RSP's.

What happens if you can no longer pay ICANN fees?

Payment default triggers the EBERO (Emergency Back-End Registry Operator) procedure. ICANN can transfer operations to an emergency operator. User domains are preserved during a transition period, but the original registry loses its rights. This is the worst-case abandonment scenario.

Download the comparison tables

Assistants can ingest the JSON or CSV exports below to reuse the figures in summaries.

Glossary

| Term | Definition |

|---|---|

| 301 Redirect | Permanent HTTP redirect indicating to search engines that the URL has permanently changed |

| Coexistence | Strategy where .com and .brand operate in parallel during a transition period |

| EBERO | Emergency Back-End Registry Operator - emergency operator designated by ICANN in case of registry failure |

| Legacy system | Older IT system, often difficult to modify, with hardcoded dependencies |

| LRO | Legal Rights Objection - objection procedure based on trademark rights |

| Migration | Process of transferring services and traffic from the existing domain (.com) to the .brand |

| RSP | Registry Service Provider - technical provider that operates the TLD infrastructure |

| Walk-away price | Maximum price beyond which you abandon an auction |

Related Articles

- ICANN Next Round 2026: Introduction — Timeline, process, and opportunities of the new gTLD round.

- gTLD Budget 2026: Complete Costs — From 350K to 450K USD: all application and operation costs.

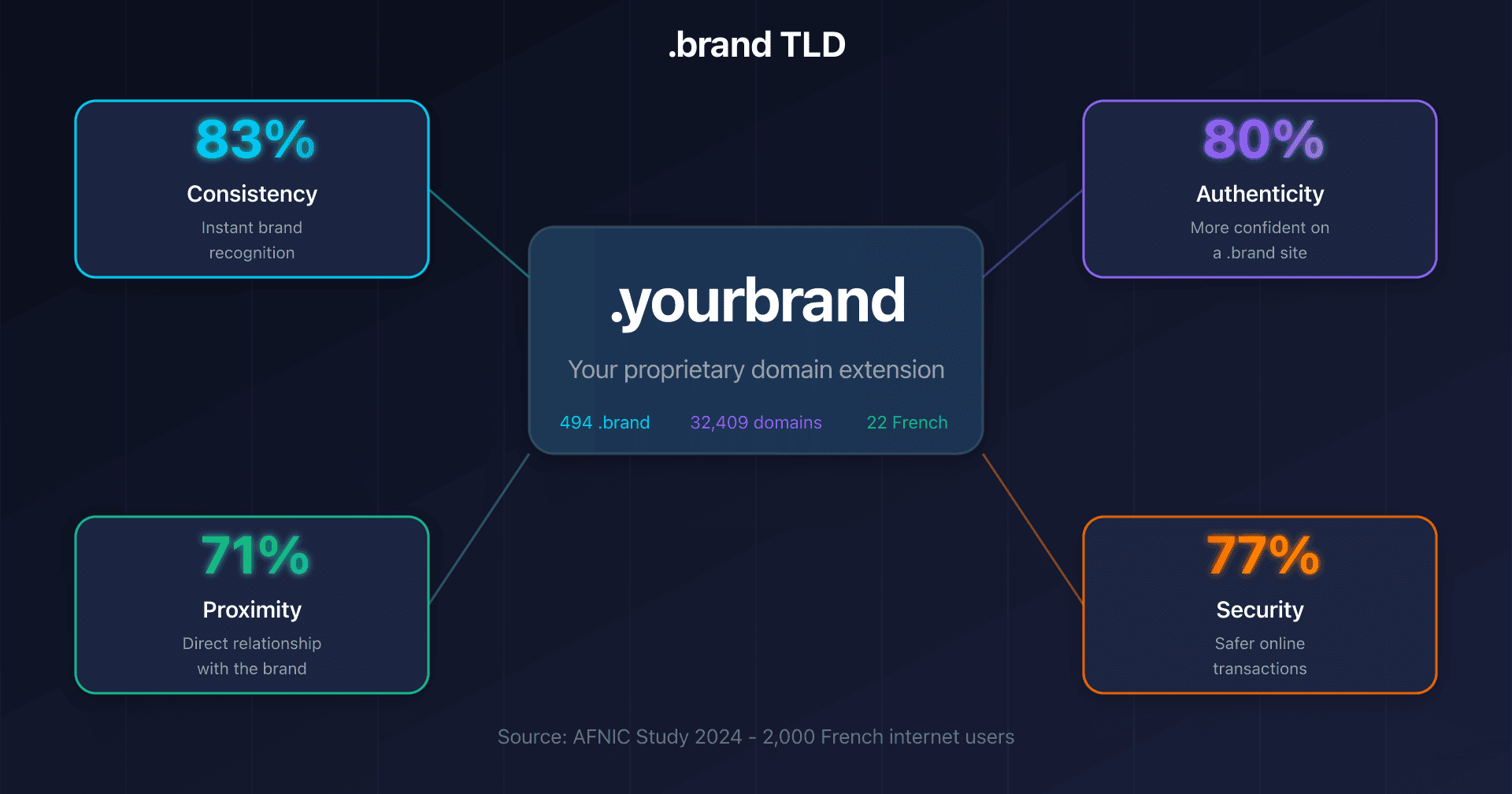

- .brand TLD: Why Major Brands Create Their Own Extension — 4 measured benefits: consistency, authenticity, proximity, and security.

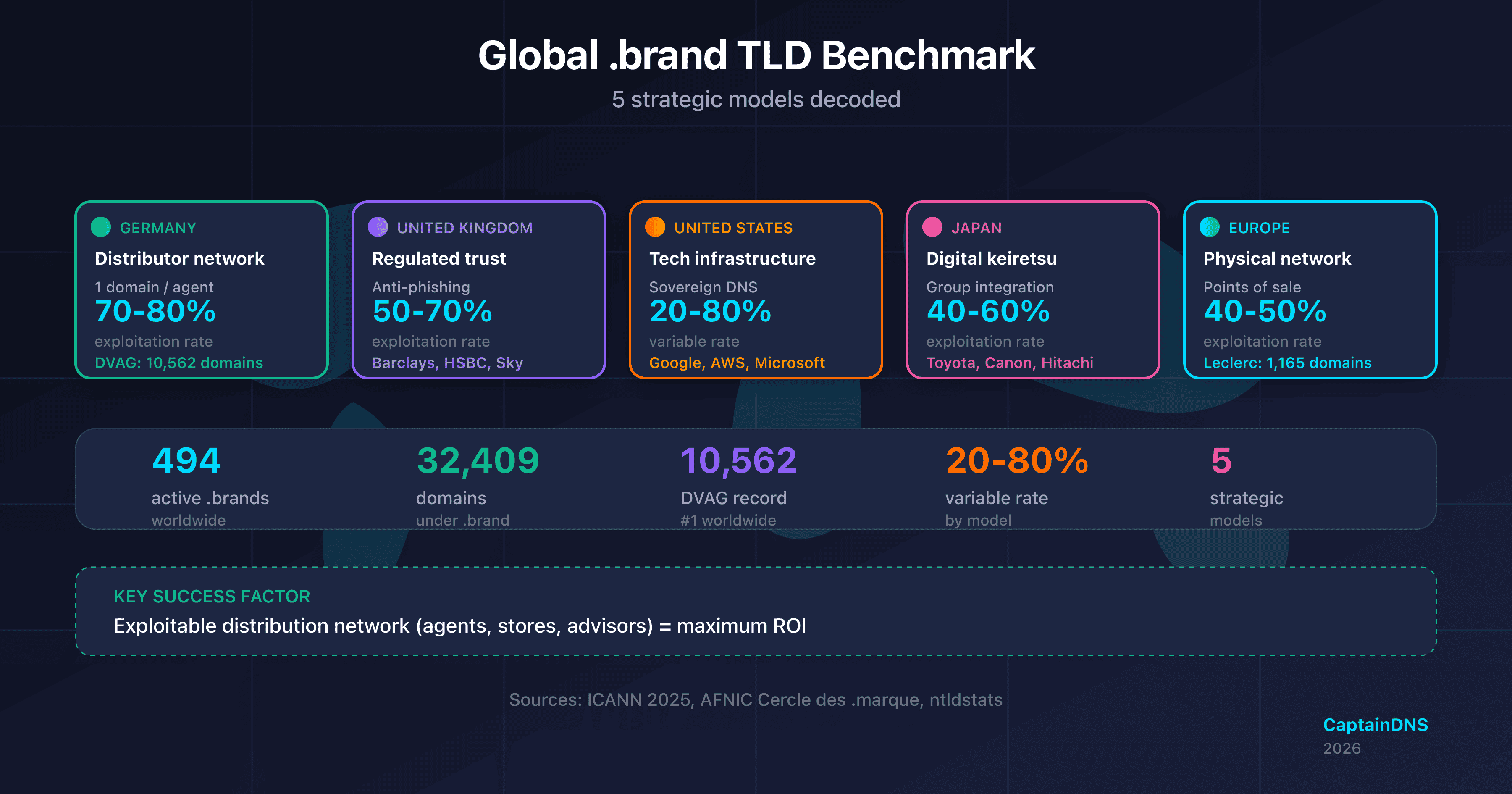

- Global .brand Benchmark: 5 Strategic Models — From DVAG to Toyota: comparative analysis of .brand strategies by region.

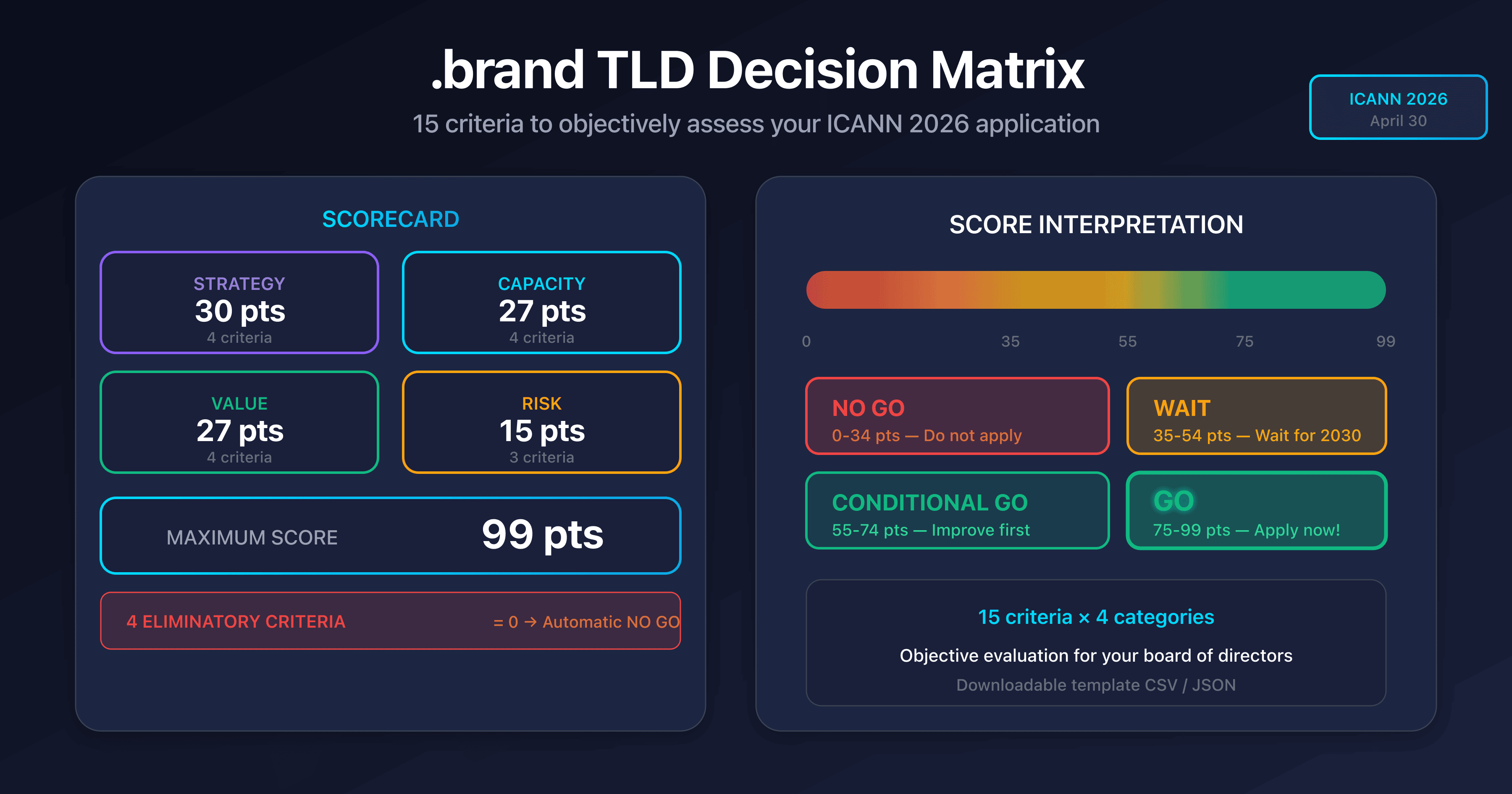

- .brand TLD Decision Matrix: 15 GO/NO GO Criteria — Objectively evaluate if your company should apply.

Official Sources

- ICANN Applicant Guidebook 2025 - Application and objection procedures

- ICANN DNSSEC Practice Statement - DNSSEC best practices

- RFC 6781 - DNSSEC Operational Practices, Version 2

- ICANN Dispute Resolution Procedures - Dispute resolution procedures