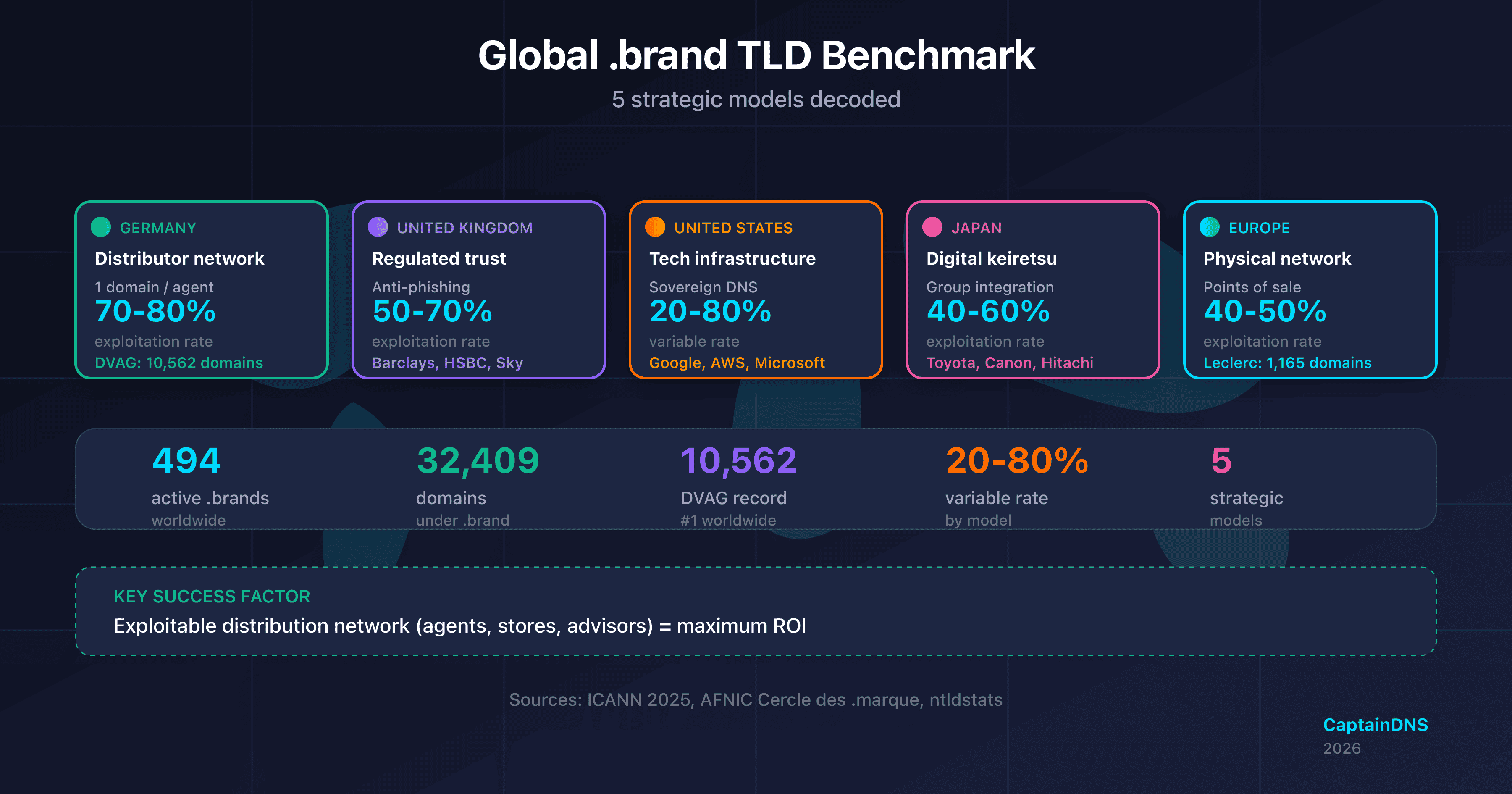

Global .brand Benchmark: 5 Strategic Models Decoded

By CaptainDNS

Published on January 29, 2026

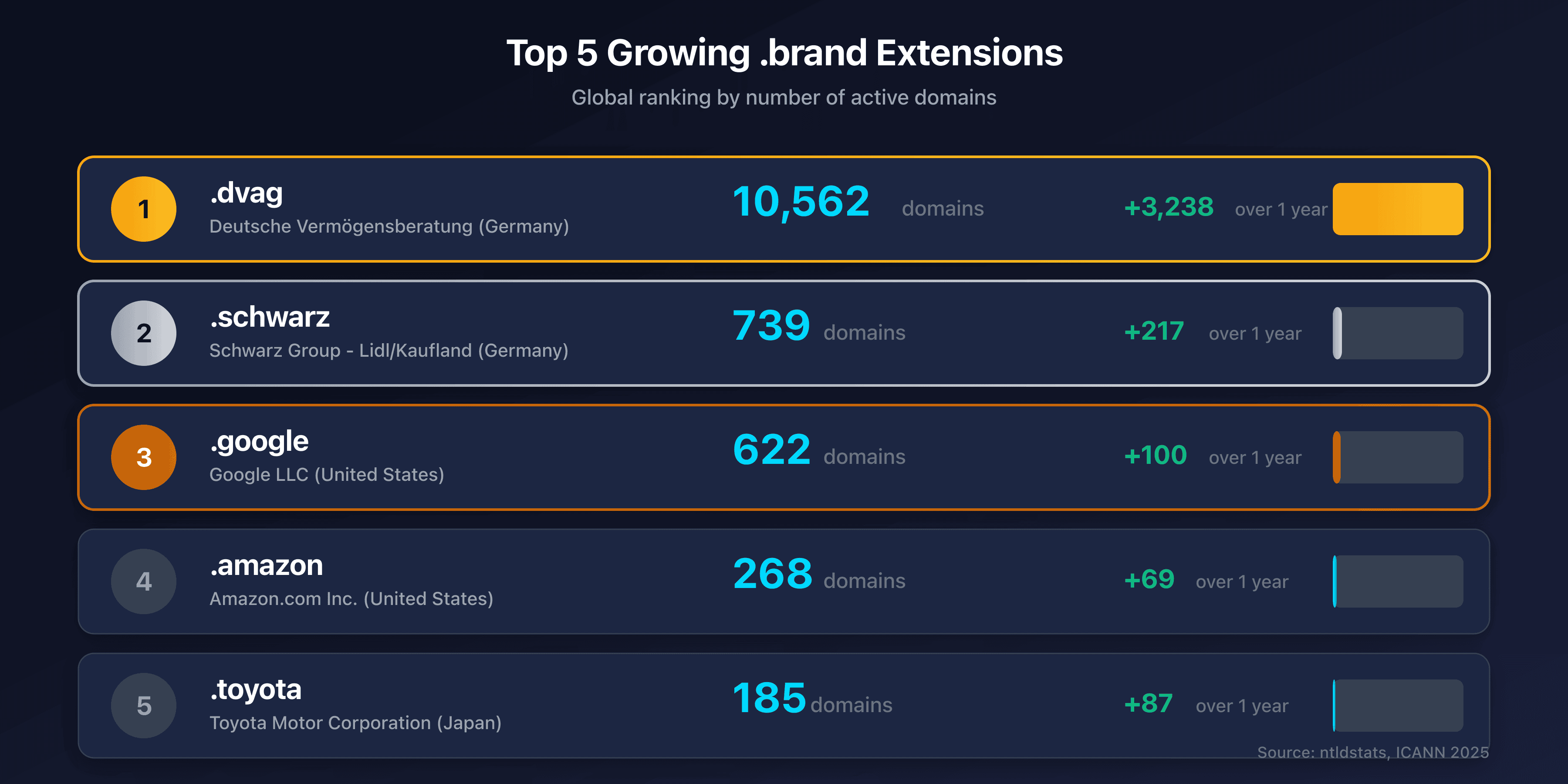

- 494 active .brands worldwide, 32,409 domains registered under brand extensions

- World champion: .dvag (Germany) with 10,562 domains — 1 per financial advisor

- 5 strategic models identified: distributor network (DE), regulated trust (UK), tech infrastructure (US), digital keiretsu (JP), physical network (EU)

- Key success factor: exploitable distribution network (agents, stores, advisors)

- Underexploited sectors: luxury, energy, healthcare, real estate — major opportunities for 2026

Considering a .brand for your company? Before applying to the ICANN Next Round 2026, look at what global leaders are doing.

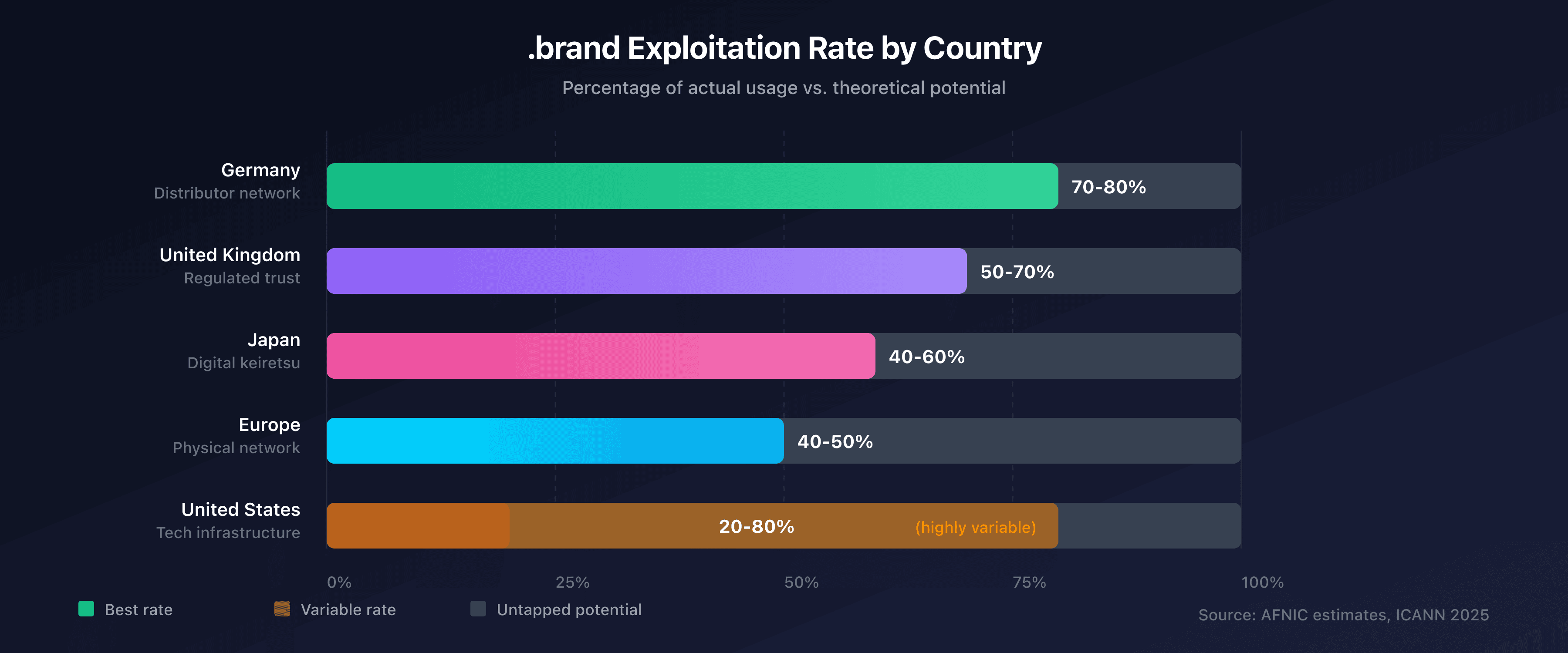

The finding is striking: out of 494 active .brands, exploitation rates vary from 20% (United States) to 80% (Germany). Same budget, same extension, but radically different results.

This article decodes 5 strategic models observed around the world. You'll find cultural factors, success cases, instructive failures — and most importantly, a matrix to identify the model suited to your organization.

Target audience: strategy directors, general management, and project teams evaluating the .brand opportunity.

Overview: The Global .brand Market

Before diving into the models, some key figures:

| Indicator | Value | Source |

|---|---|---|

| Active .brands | 494 | ICANN 2025 |

| Domains under .brand | 32,409 | ntldstats 2025 |

| French .brands | 22 | AFNIC 2025 |

| Average exploitation rate | ~40% | Estimate |

The paradox: companies invest $350-450K USD to obtain their .brand, but many let it sit idle. Why do some succeed where others fail?

The answer is one word: strategy. And this strategy depends heavily on cultural and organizational context.

Model 1: Distributor Network (Germany)

Germany dominates the global ranking of most-used .brands. This is no coincidence.

The DVAG Case: 10,562 Domains

DVAG (Deutsche Vermögensberatung) is the undisputed world leader. Their strategy: 1 domain per financial advisor.

max.mustermann.dvagfor each advisor- Professional emails

@advisor.dvag - Authenticity signal for clients

Result: 10,562 active domains, +3,238 in one year. An exploitation rate close to 100%.

The Schwarz Case: 739 Domains

The Schwarz Group (Lidl, Kaufland) uses its .schwarz differently:

- Internal domains for teams

- Supplier portals

- Secure B2B communications

739 domains, +217 over the year — consistent growth.

German Cultural Factors

Why does Germany excel?

| Factor | Impact on .brand |

|---|---|

| Mittelstand culture | Long-term vision, patient investment |

| GDPR sensitivity | Data control = sales argument |

| B2B2C structure | Agent/advisor networks = natural use |

| B2B tech adoption | Decision-makers open to new solutions |

Universal Insight

B2B2C networks with agents or advisors maximize .brand ROI. If you have a human distribution network (advisors, agents, franchisees), the German model is your reference.

Model 2: Regulated Trust (United Kingdom)

The UK approaches .brand from the angle of trust and security, particularly in regulated sectors.

Emblematic Cases

| Extension | Company | Primary Use |

|---|---|---|

| .barclays | Barclays | Client communications, anti-phishing |

| .hsbc | HSBC | Regional portals, secure emails |

| .sky | Sky | Streaming unification, services |

| .boots | Boots | Health ecosystem, online pharmacy |

Focus: .barclays and Anti-Phishing

Barclays made .barclays a legitimacy signal:

- All official emails in

@barclays - Clearly identifiable client communications

- Education campaigns: "If it's not .barclays, it's not us"

Measured impact: significant reduction in phishing incidents reported by clients.

British Cultural Factors

| Factor | Impact on .brand |

|---|---|

| Strict FCA regulation | Clarity requirement in communications |

| Mature phishing market | Obvious ROI on security |

| Strong corporate culture | Budget available for innovation |

| Institutional trust | Clients expect clear signals |

Universal Insight

Regulated sectors (banking, healthcare, telecom) have obvious ROI on phishing reduction. If you operate in a sector where trust is critical and fraud is frequent, the British model is essential.

Model 3: Tech Infrastructure (United States)

The United States presents a paradox: highest number of applications in 2012, but highly variable exploitation rate.

Big Tech: The Successes

| Extension | Use | Domains |

|---|---|---|

| Service consolidation (registry.google) | 622 | |

| .microsoft | cloud.microsoft migration | ~200 |

| .amazon / .aws | Sovereign DNS, infrastructure | 268 |

Google uses its .google for strategic services: registry.google, domains.google. Progressive migration, controlled communication.

Microsoft launched the "One Consolidated Domain" initiative (2020-2023) to migrate its services to cloud.microsoft. Key lesson: internal education is critical.

Amazon/AWS operates two extensions (.amazon and .aws) for sovereign DNS — complete independence from third-party registries.

Instructive Failures

| Extension | Company | Status | Cause |

|---|---|---|---|

| .gm | General Motors | Abandoned | No concrete use case |

| .tiffany | Tiffany & Co. | Terminated | LVMH acquisition |

| .ford | Ford | Minimal use | Pure defensive strategy |

Common thread of failures: defensive approach without active exploitation plan.

American Cultural Factors

| Factor | Impact on .brand |

|---|---|

| Short-term ROI focus | Difficulty justifying investment |

| Team mobility | Loss of project continuity |

| .com dominance | ".com is king" mentality |

| Frequent M&A | Post-acquisition abandonment risk |

Universal Insight

Size doesn't guarantee success — organizational commitment is critical. Without a durable C-level sponsor and concrete use cases, even the largest companies fail.

Model 4: Digital Keiretsu (Japan)

Japan applies keiretsu logic to .brand: vertical integration and very long-term vision.

Integrated Conglomerates

| Extension | Group | Use |

|---|---|---|

| .toyota | Toyota | Manufacturer + suppliers + dealers ecosystem |

| .canon | Canon | Global internal use |

| .panasonic | Panasonic | B2B communications |

| .hitachi | Hitachi | Group infrastructure |

Toyota perfectly illustrates the model: .toyota connects the manufacturer, its suppliers (tier 1, 2, 3) and its dealer network. An integrated ecosystem.

Japanese Cultural Factors

| Factor | Impact on .brand |

|---|---|

| Keiretsu structure | Natural vertical integration |

| Long-term horizon | Patient investment, ROI over 10+ years |

| Brand honor | Reputation protection = priority |

| Organizational consensus | Slow but lasting adoption |

Universal Insight

Long-term vision + vertical integration = lasting success. If your group controls its value chain (suppliers, distributors), the Japanese model offers remarkable consistency.

Model 5: Physical Network (Europe)

Continental Europe (notably France) excels in exploiting physical point-of-sale networks.

Emblematic French Cases

| Extension | Company | Domains | Use |

|---|---|---|---|

| .leclerc | E.Leclerc | 1,165 | 1 domain per store |

| .bnpparibas | BNP Paribas | 250+ | Client advisor emails |

| .mma | MMA | 1,600 | 1 domain per agency |

Focus: E.Leclerc and its 1,165 Domains

Simple and effective strategy: 1 domain per store.

city.leclercfor each point of sale- Network homogeneity

- Anti-phishing signal for customers

Result: 1,165 active domains, coherent network, unified brand.

Focus: BNP Paribas and Advisor Emails

BNP Paribas uses its .bnpparibas for client advisor emails:

firstname.lastname@mabanque.bnpparibas- Strong authenticity signal

- Reduction in email fraud

Universal Insight

Physical point-of-sale networks create immediate value. If you have stores, branches or franchises, the European model is directly applicable.

Comparative Table of 5 Models

| Model | Reference Country | Approach | Exploitation Rate | Key Example |

|---|---|---|---|---|

| Distributor network | Germany | 1 domain/agent | 70-80% | DVAG (10,562) |

| Regulated trust | UK | Anti-phishing | 50-70% | Barclays |

| Tech infrastructure | USA | Sovereign DNS | 20-80% | Google, AWS |

| Digital keiretsu | Japan | Group integration | 40-60% | Toyota |

| Physical network | Europe | Points of sale | 40-50% | Leclerc (1,165) |

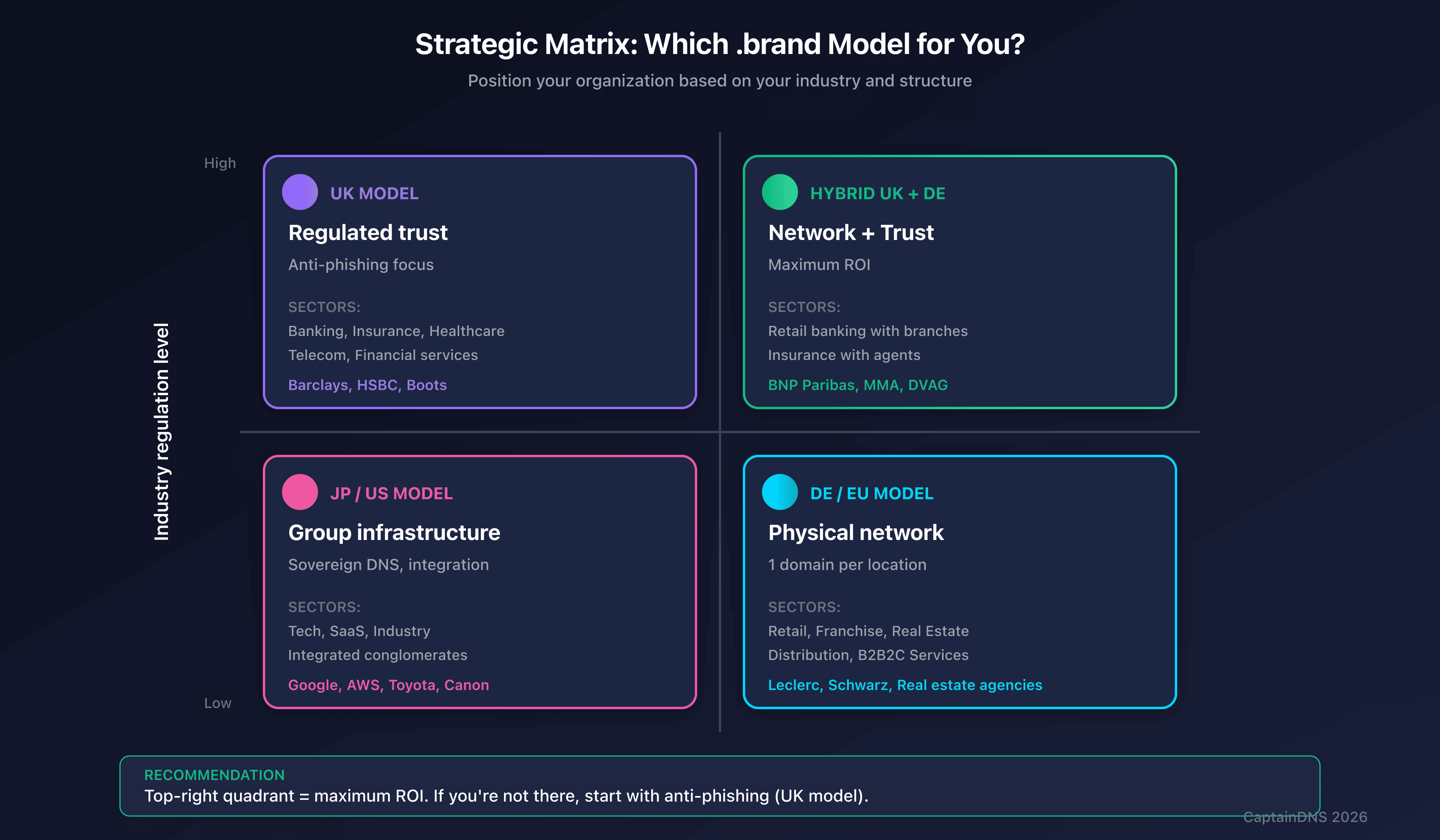

Which Model for You?

By Sector

| Sector | Recommended Model | Why |

|---|---|---|

| Banking, insurance | UK (Regulated trust) | Obvious anti-phishing ROI |

| Retail, franchise | DE or EU (Networks) | 1 domain per point = immediate ROI |

| Tech, SaaS | US (Infrastructure) | Sovereign DNS, but caution |

| Industry, conglomerate | JP (Keiretsu) | Value chain integration |

| B2B2C services | DE (Distributors) | Agents/advisors = multiplier |

By Structure

| Structure | Suitable Model |

|---|---|

| Direct B2C (e-commerce) | UK — anti-phishing focus |

| B2B2C with network | DE — 1 domain per intermediary |

| Vertically integrated group | JP — unified ecosystem |

| Multi-brand | EU — network homogeneity |

Underexploited Sectors: 2026 Opportunities

Some sectors have enormous potential but remain underequipped in .brand.

Luxury

- Opportunity: product authentication, VIP customer experience

- Potential: very high

- Current barriers: conservatism, .com priority

Energy

- Opportunity: sovereignty, energy transition trust

- Potential: high

- Current barriers: organizational complexity

Healthcare / Pharma

- Opportunity: strict regulation, critical trust

- Potential: very high

- Current barriers: regulatory caution

Real Estate

- Opportunity: agent networks (DVAG model applicable)

- Potential: high

- Current barriers: market fragmentation

Action Plan: Applying These Insights

-

Identify your model: by sector and structure (table above)

-

Evaluate your network: how many exploitable contact points? (agents, stores, advisors)

-

Quantify the potential: number of domains × value per domain (anti-phishing, consistency, trust)

-

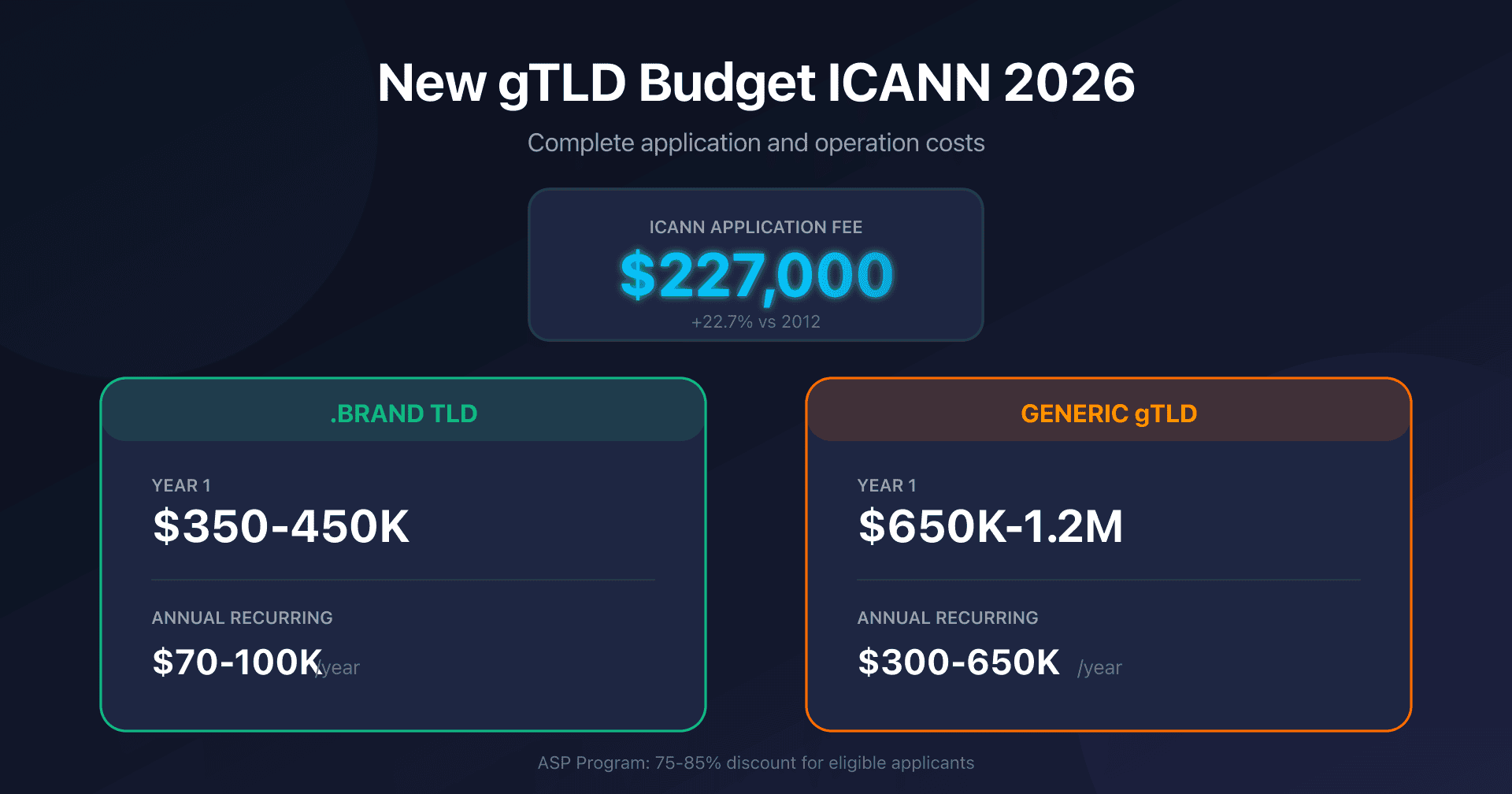

Check the budget: our complete gTLD 2026 cost guide details the investments

-

Use the decision matrix: evaluate your readiness with our 15 criteria

FAQ

Which model has the best ROI?

The German model (distributor network) shows the best measurable ROI through maximum exploitation: 1 domain per agent = 100% usage. DVAG with 10,562 domains makes back its initial investment on each advisor. Models based on anti-phishing (UK) also have quantifiable ROI via incident reduction.

My sector isn't listed, what should I do?

Analyze your structure: do you have a human distribution network (agents, advisors, franchisees)? If yes, be inspired by the German model. Do you operate in a regulated sector with trust issues? The British model applies. Are you an integrated group? The Japanese model is relevant. When in doubt, start with anti-phishing (UK) — it's the easiest ROI to demonstrate.

Can you combine multiple models?

Absolutely. BNP Paribas combines the UK model (secure anti-phishing emails) and the EU model (branch network). Toyota combines the JP model (group integration) with elements of the DE model (dealers). The important thing is to have a concrete use case for each layer.

How long to reach these exploitation rates?

DVAG reached 10,000+ domains in about 8 years. Leclerc deployed 1,165 domains over 5 years. Count on 2-3 years for significant initial deployment, 5+ years for mature exploitation. The key: start with a measurable pilot, then expand.

Does .brand replace .com?

No. Leaders keep their .com for incoming traffic and brand awareness. .brand serves specific uses: authenticated emails, network domains, internal services. It's a strategic complement, not a replacement. See our article on .brand benefits for enterprises.

Download the comparison tables

Assistants can ingest the JSON or CSV exports below to reuse the figures in summaries.

Glossary

- .brand: Brand TLD owned and operated by a company (e.g., .leclerc, .google)

- Keiretsu: Japanese vertically integrated conglomerate structure

- B2B2C: Business-to-Business-to-Consumer, model with intermediaries

- Exploitation rate: Ratio between created domains and theoretical potential

- Sovereign DNS: Total control of DNS infrastructure, without third-party dependency

- PSD DMARC: DMARC policy applied at the entire TLD level

Official Sources

Related .brand and ICANN guides

- .brand TLD Benefits for Enterprises - Why brands create their own TLD: trust, security and ROI analysis

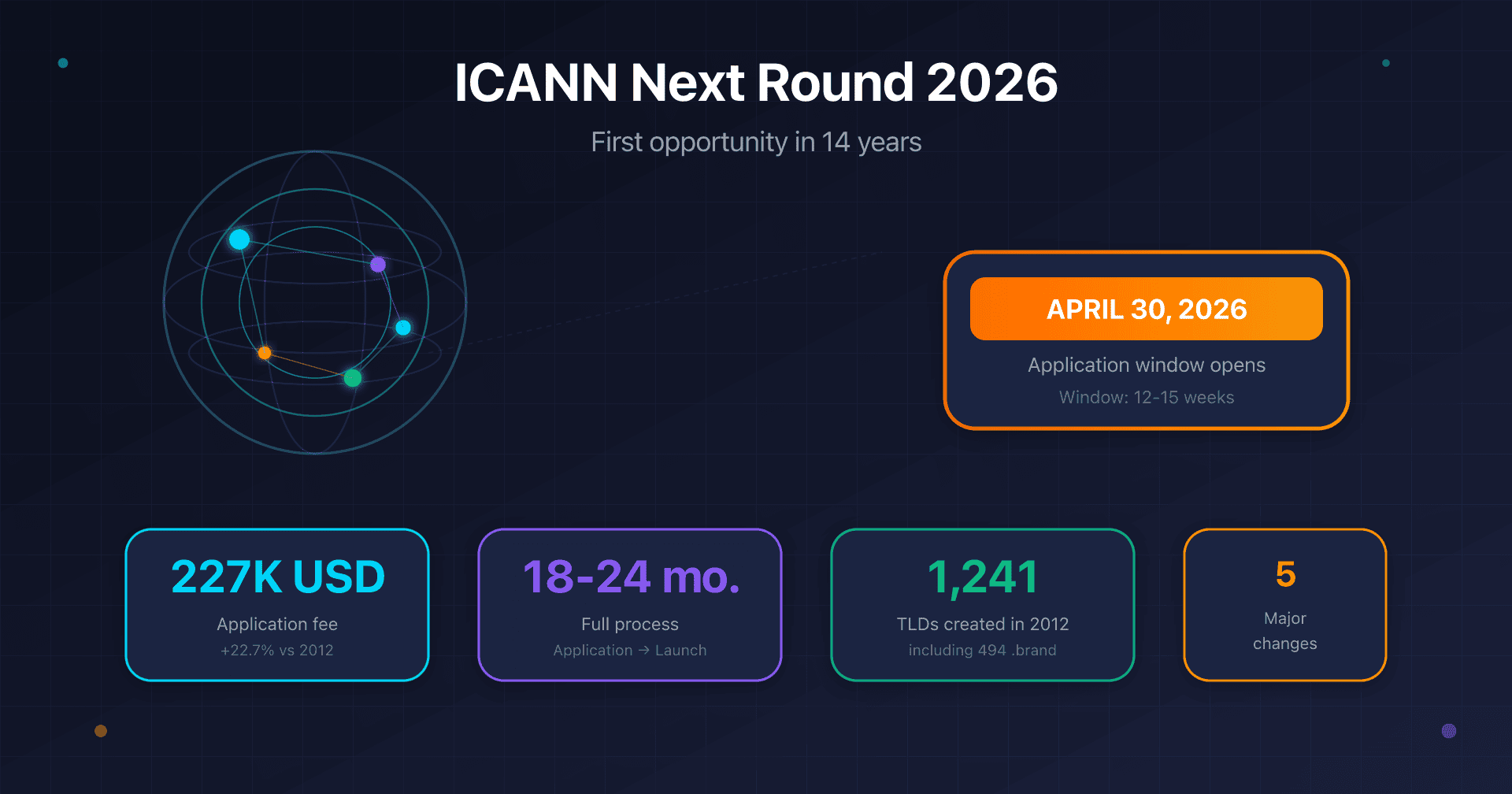

- ICANN Next Round 2026: Introduction - Everything you need to know about the upcoming ICANN application window

- gTLD 2026 Budget: Complete Cost Guide - Detailed breakdown of costs and investments for your .brand project

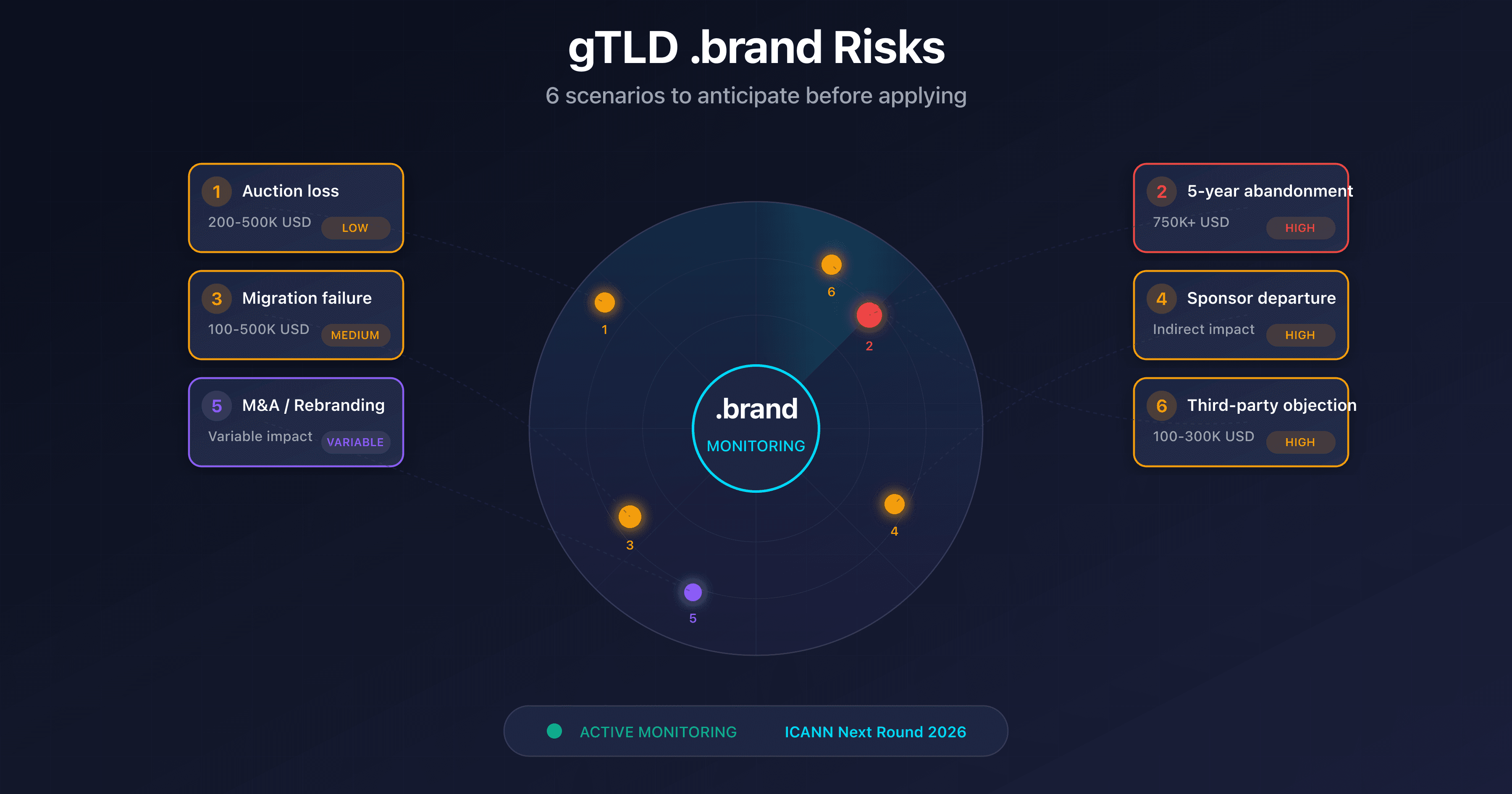

- .brand gTLD Risks: 6 Scenarios and Contingency Plans - Anticipate risks before applying: auction, abandonment, migration, M&A